LEAGUE OF DENTED CHAMPIONS : IIPM

IIPM PUBLICATION

There is no magic formula for success in business. Neither is there one certain way to stumble en route. The roller coaster ride of Hindustan Lever Ltd. (HLL) in India proves this beyond doubt. When the market leader in India’s FMCG sector, which was supposed to be setting benchmarks for the entire industry can falter (on its own benchmarks), it shows how sheerly unpredictable the corporate world of today has become. Or perhaps, it shows how even the best can make mistakes in setting roadmaps for the future.

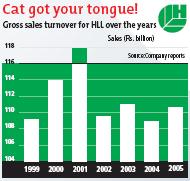

HLL went for a massive acquisition spree by the then Chairman Keki Dadiseth, as if it was running a marathon.  The strategy worked well for the previous decade, as turnover grew from Rs.37.75 billion in 1995 to Rs.117.81 billion by 2001. Since 2001, revenues went into decline. Dadiseth’s successor M. S. Banga attributed HLL’s falling fortunes to the rapid opening of economy coupled with a steep drop in interest rates, which resulted in “many new avenues of expenditure for the consumer’s growing income.” The premium positioned HLL brands took a major hit, as customers started opting for cheaper substitutes. Competition in different segments caused declining sales, Nirma being the first to make a significant dent. The cliché of the giant’s size being his undoing was proving true here as well.

The strategy worked well for the previous decade, as turnover grew from Rs.37.75 billion in 1995 to Rs.117.81 billion by 2001. Since 2001, revenues went into decline. Dadiseth’s successor M. S. Banga attributed HLL’s falling fortunes to the rapid opening of economy coupled with a steep drop in interest rates, which resulted in “many new avenues of expenditure for the consumer’s growing income.” The premium positioned HLL brands took a major hit, as customers started opting for cheaper substitutes. Competition in different segments caused declining sales, Nirma being the first to make a significant dent. The cliché of the giant’s size being his undoing was proving true here as well.

Food was recognised as a thrust area for future growth by HLL way back in 1997. However, despite being an early mover, HLL could not capitalise on its food division. Dadiseth’s successor M. S. Banga began to focus on power brands and trimming of the portfolio.

However these strategies have not succeeded in getting HLL’s revenues back to 2001 levels. The company faced five consecutive quarters of depressing year on year profits before achieving profit growth in the quarter ending June 2005. HLL is now trying to focus on category led growth, rural penetration and more on its core segment of home & personal care products. The company also faces a more formidable challenge today with ITC getting increasingly aggressive in the FMCG segment.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home